tucson sales tax rate change

The December 2020 total local sales tax rate was also 8700. 520 724-8341 Fax.

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

City of South Tucson Tax Code effective 10-01-2019 150 KB Summary of Proposed Modified Fees draft 04-29-2019 for eff.

. The Tucson sales tax rate is. Tax Rates onafter January 1 2022. Effective July 01 2016 the per room per night surcharge will be 4.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. This change has no impact on Arizona use. Corona de Tucson AZ Sales Tax Rate The current total local sales tax rate in Corona de Tucson AZ is 6100.

Tucson approves increase in hotel tax surcharge. The County sales tax rate is 0. Regardless of when a contract is executed if change orders are executed on or after February 1 2018 they will be subject to the new city tax rate of 26.

Retail Sales 017 to five percent 500 Communications 005 to five and one-half percent 550 and Utilities 004 to five and one-half percent 550. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits. Calls to suspend gas taxes across US.

This change has no impact on Arizona use tax assessment which remains at 56. The sales tax increase is aimed at the business categories because they are currently taxed below the average across all categories of 55 percent according to Lourdes Aguirre city. Mar 10 2022 Updated Mar 12 2022.

Tax Inquiry Property Search Tax Payment Tax Statement. The city has a choice between four tax rates a quarter half 75 or full-cent tax to replace the current half-cent sales tax from the 2017 Prop. CURRENT YEAR RATE PRIOR YEAR RATE CHANGE IN TAX RATE.

There are a total of 101 local tax jurisdictions across the state collecting an average local tax of 2132. The attached pdf contains the most recent changes to City Code Chapter 11 related to tax rates and license fees. Groceries and prescription drugs are exempt from the Arizona sales tax.

The form is fillable if opened in Adobe Acrobat or Adobe Reader otherwise it may be printed and. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. Arizona has 511 special sales tax jurisdictions with local sales taxes in.

The increase will bring in an estimated 37 million in the coming year to the city coffers. The minimum combined 2022 sales tax rate for Tucson Arizona is. Average Sales Tax With Local.

The County sales tax rate is. The Tucson sales tax rate is 87. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

Republicans previously turned aside proposals from Democrats for steps such as lowering the sales tax to 65 increasing the states tax deduction on rent from 3000 to 5000 a year and. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86.

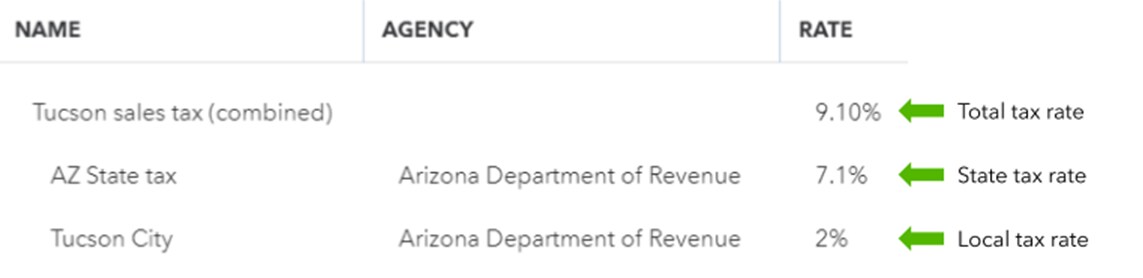

The December 2020 total local sales tax rate was also 6100. The Arizona sales tax rate is currently. How much is the sales tax in Tucson Arizona.

This is the total of state county and city sales tax rates. Arizona state sales tax. The South Tucson City Council is considering raising sales taxes by half a percent on utilities communications and retail sales to sustain an estimated budget deficit of 293000 in 2020.

The current total local sales tax rate in Tucson AZ is 8700. Grow as prices surge. The Tucson sales tax rate is 26.

Tax Rates through December 31 2021. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. This is the total of state county and city sales tax rates.

The minimum combined 2021 sales tax rate for Tucson Arizona is 87. The Tucson City Council passed the increase in part because it was facing a 43 million. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

TAX LIEN INFORMATION TAX LIEN SALE SUBSCRIBER SERVICES. The 2018 United States Supreme Court decision in South Dakota v. Effective July 01 2009 the per room per night surcharge will be 2.

Effective July 01 2003 the tax rate increased to 600. TUCSON AZ Tucson News Now - Tucsons hotel tax surcharge doubles on July 1 from 2 a night to 4 a night. 4 rows The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County.

Gas prices are shown Monday March 7. Tucson AZ Sales Tax Rate. Autolist says that Arizona ranked 19th in the country last month for vehicle affordability.

Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement. Contracting - Speculative Builders. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725.

19-01 to increase the following tax rates. 240 North Stone Avenue Tucson AZ 85701-1199 Phone. Is it cheaper to buy a car in Arizona.

Pima County sales tax. Please complete and return this form for any contracts or projects inside Tucson city limits that qualify for this grandfathering. Tax Code Section.

The Arizona sales tax rate is currently 56.

Rate And Code Updates Arizona Department Of Revenue

Missouri Car Sales Tax Calculator

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

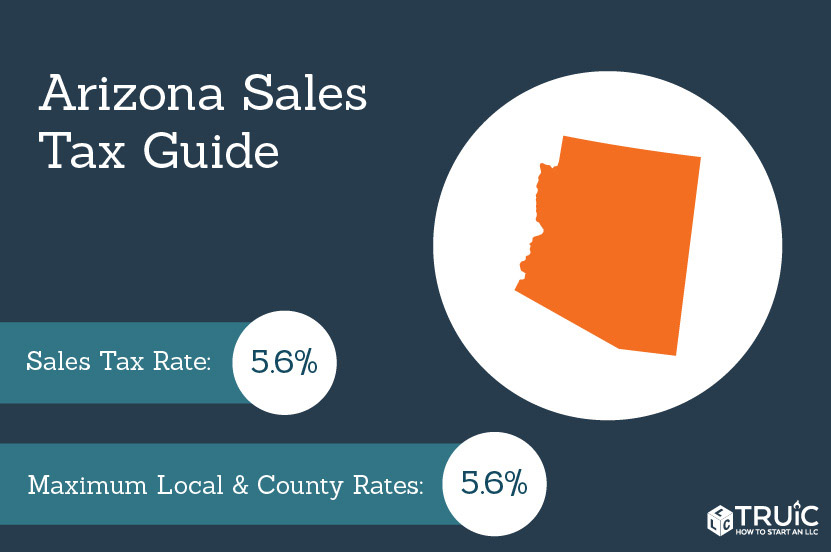

Arizona Sales Tax Small Business Guide Truic

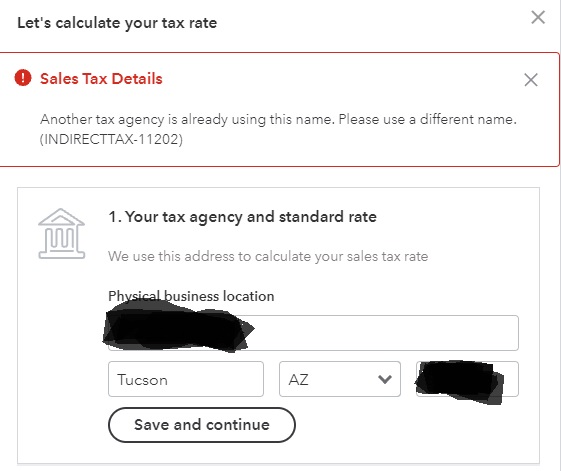

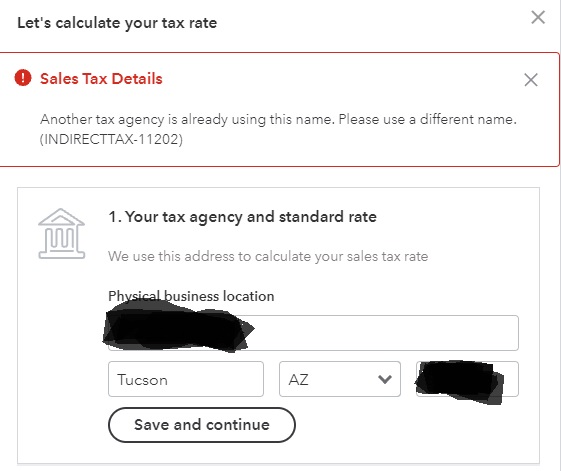

Solved I Struggled With The Automatic Sales Tax Setup No

Property Taxes May Move Into Suburbs Government Politics Tucson Com

State And Local Sales Taxes In 2012 Tax Foundation

Solved I Struggled With The Automatic Sales Tax Setup No

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

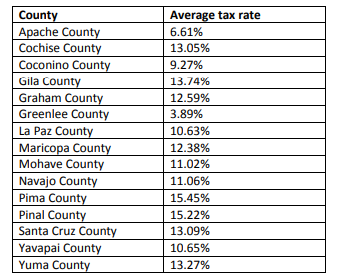

Property Taxes In Arizona Lexology

Arizona Sales Tax Rates By City County 2022

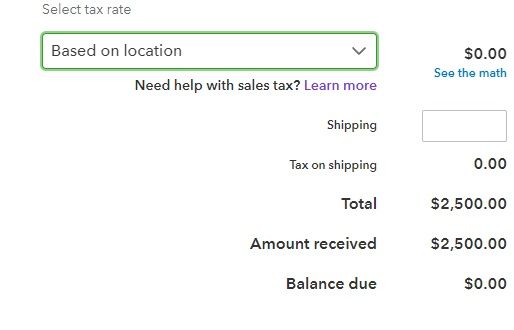

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Property Taxes May Move Into Suburbs Government Politics Tucson Com